NanFran's Cool Investments

WSJ reports today that Nancy Pelosi is one of several "green investors" participating in a campaign to "save" ski resorts from global warming.

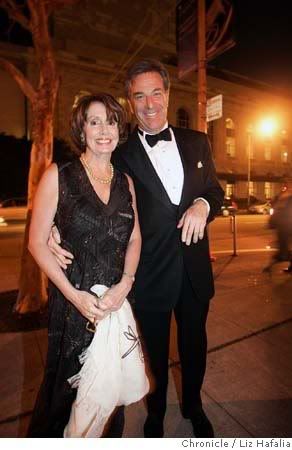

WSJ reports today that Nancy Pelosi is one of several "green investors" participating in a campaign to "save" ski resorts from global warming.For example, Sugar Bowl Ski Resort here in 2004 launched a "Start Global Cooling" campaign with Clif Bar & Co., a maker of protein bars in Berkeley, Calif. Under the program, Sugar Bowl -- privately owned by a consortium composed of some of the San Francisco Bay Area's wealthiest residents, including House Speaker Nancy Pelosi -- invests about $25,000 to $30,000 a year in wind farms and other renewable energy sources, says Greg Murtha [a strange coincidence there ...], the resort's marketing director. The amount is calculated by multiplying the amount of energy Sugar Bowl uses by the cost per kilowatt hour of the renewable power it's investing in.NanFran is going to be a bigtime speaker at today's global warming rally in DC, so I wondered, is everything she and Big Bucks hubby Paul invest in green? It turns out Paul's been very careful with the portfolio because he knows it will be under scrutiny and investments in, say, Halliburton, just wouldn't look good. So, here's what the Chronicle found:

How very chic-Lib. High tech, homey, wine and cheeze and nice food at nice resorts. Paul Pelosi has done a very good job of avoiding controversial investments -- but you just can't avoid investing in global warming, so let's take apart the Pelosi portfolio.The bulk of the Pelosis' money comes from investments in stocks and real estate. Operating through Financial Leasing Services, his San Francisco investment firm, Paul Pelosi owns stock in companies including Microsoft, AT&T, Cisco Systems, Disney, Johnson & Johnson and a variety of tech stocks.

Real estate investments include a four-story office building at 45 Belden St. in the Financial District, office buildings on Battery and Sansome streets near the Embarcadero, a building housing a Walgreens drugstore near Ocean Beach and other commercial property in San Anselmo.

Other investments include a St. Helena vineyard worth between $5 million and $25 million, a $1 million-plus townhome in Norden (Nevada County), and minority interests in the Auberge du Soleil resort hotel in Rutherford, the CordeValle Golf Club in San Martin, and the Piatti Italian restaurant chain.

- High tech companies: Microsoft, Cisco and AT&T are all 100% reliant on electricity and the growing omnipresence of computers is one of the largest drivers of increasing energy demand. Plus, manufacturing all those boards and discs takes a heap of juice. And if you've bought a Microsoft product lately (as opposed to downloading it), you know you get one plastic disc, some paper and a great big box. Not exactly eco-friendly packaging.

- Disney: Hollywood is second only to the oil industry in SoCal when it comes to pollution. Diesel generators abound, electricity arcs through lights and recording equipment ... and the air conditioned trailers favored by greenie stars. Disney's theme parks attract millions who arrive by jet, car and SUV.

- Real estate: No word on whether these buildings are green, but they are clustered in older parts of the city, so unless they've undergone major retrofits, they're bigtime greenhouse gas producers. I noted that 45 Belden is home to at least one environmental group and a pack of asbestos-sniffing litigators.

- Vineyards: Agricultural chemicals are major emitters of greenhouse gases.

- Resorts and Golf: Is the resort green, or does it churn those heaters and air-conditioners like there's no tomorrow? Is the golf course organic, or do they actually mow it with gas mowers and dose it with ag chemicals? Do people arrive on foot or by car?

- Italian restaurants: I am not going to criticize investments in Italian restaurants. Forget it.

Labels: Climate change, Global warming, Pelosi

<< Home